Why Spending Habits Shift with PayRange

Laundromat owners often express a common concern when considering adding PayRange’s mobile payment solution to their machines: the belief that their customers won’t spend more money per load.

They might think, “My customers are budget-conscious, spending around $10.00 per laundry visit. Switching to mobile payments won’t change that—they won’t spend more with their phones than they do with coins.”

But what if we told you a different story?

A story validated by over 3,000 laundromats that have equipped their machines with PayRange. Before diving into the details, let’s first understand why your customers’ spending habits appear the way they do today.

Do you know why your customers typically spend just $10.00 per visit at your laundromat?

It’s not because they’ve decided that’s all they want to spend. In reality, their spending is constrained by a significant inconvenience they face before even stepping into your laundromat—getting coins.

On laundry day, your customers often have to visit their bank or credit union to purchase a roll of quarters. Many of these financial institutions only offer rolls of 40 quarters, equivalent to $10.00. This limit directly dictates how much your customers spend at your machines.

Remove the payment barrier

Let’s explore what happens when a customer walks into your laundromat with that $10.00 roll of quarters. Because they only have a finite amount of money, they might opt to wash a large load of mixed whites and darks instead of separating them into two cycles. When it’s time to dry, their clothes may not be fully dry after one cycle, but their quarters have run out, leaving them no choice but to leave with damp clothes. When you offer your customers additional payment options beyond just coins, you remove these limitations.

With PayRange, your customers are no longer constrained by the number of quarters they have. They’re more likely to separate their whites and darks, resulting in two separate wash cycles, and they can ensure their clothes are completely dry before leaving.

Average spend increases with mobile payments

So, while it might seem at first glance that your customers won’t spend more when you introduce mobile payment options, it’s important to recognize that their previous spending habits were shaped by the limitations of coin-based payments.

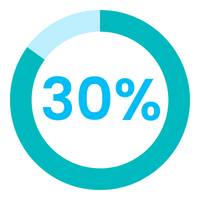

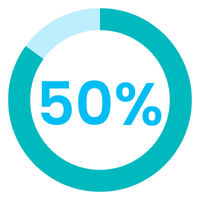

On average, PayRange laundromat owners experience

With over 500,000 PayRange-equipped machines and 8,000 operators, we’ve been fortunate to hear from our customers on the clear benefits of PayRange:

- Customers are doing laundry more frequently, boosting usage.

- Service calls have decreased due to fewer machine issues.

- Each customer is running more loads.

- Coin collection costs have significantly dropped.

Future-Proof Your Laundromat

In today’s fast-paced, tech-driven world, mobile payments are rapidly becoming the preferred choice for consumers, and this trend will only continue to grow. As a laundromat owner, it’s crucial to ask yourself if your business is truly ready for the future. By adding PayRange to your machines, you can easily meet the rising demand for mobile payment options, providing a seamless, cashless experience that today’s customers expect.

Not only does PayRange simplify the payment process, but it also keeps your business ahead of the curve, ensuring you’re equipped to handle future consumer trends. Mobile payment acceptance isn’t just a convenience—it’s a necessity for long-term growth and customer satisfaction.